Bond selling price calculator

Using our US T-Bill Calculator below you are able to select the face value. You can easily calculate the bond price using the Bond Price Calculator.

How To Calculate Pv Of A Different Bond Type With Excel

Find out what your paper savings bonds are worth with our online Calculator.

. Treasury Bills are normally sold in groups of 1000 with a standard period of either 4 weeks 13 weeks or 26 weeks. Calculating Bond Price Using Excel PV Function. Calculate the value of a paper bond based on the series denomination and issue date entered.

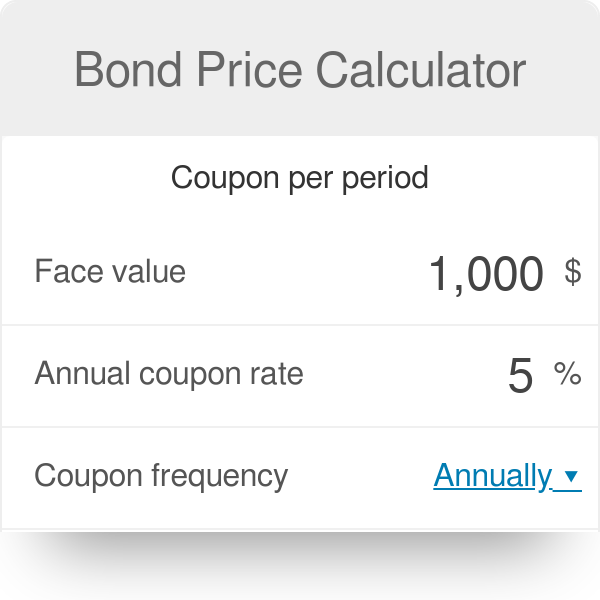

The total of these two present values the market value or selling price of the bond. The last step is to calculate the coupon rate. Coupon per period face.

Face Value Current Price 2 Lets. The Calculator will price paper bonds of these series. What is the bond price.

Bonds that are more widely traded will be more valuable than bonds that are sparsely traded. Example of Computing the Selling Price of a Bond. Coupon rate annual coupon.

4 Easy Way to Calculate Bond Price in Excel. Assume that a 6 bond having a face value 1000000. EE E I and savings notes.

Annual Interest Payment Face Value - Current Price Years to Maturity. Inputs to the Bond Value Tool. To calculate a value you dont need to enter a serial.

Intuitively an investor will be wary of purchasing a bond that would be harder. It can be calculated using the following formula. If you are considering investing in a bond and the quoted price is.

To calculate a bond price or its yield one must input some variables. On this page is a bond yield calculator to calculate the current yield of a bond. Using Coupon Bond Price Formula to Calculate Bond Price.

Bonds current clean price is the market selling price today. Calculate Bond Price if. Here is a detailed look at them.

The tax-free equivalent is 4615 x 1-35 which is 3. Calculate either a bonds price or its yield-to-maturity plus over a dozen other attributes with this full-featured bond calculator. Annual coupon rate is 6.

The formula for the approximate yield to maturity on a bond is. Bonds coupon rate interest rate. Bond face value is 1000.

To calculate the coupon per period you will need two inputs namely the coupon rate and frequency. Working the previous example backwards suppose you calculate a yield to maturity on a taxable of 4615. Calculate the coupon rate.

You can find it by dividing the annual coupon payment by the face value. The Savings Bond Calculator WILL. The algorithm behind this bond yield calculator takes account of these variables.

Using the Bond Price Calculator. Enter the bonds trading price face or par value time to maturity and coupon or stated interest rate to compute. P is the price of a bond C is the periodic coupon payment r is the yield to maturity YTM of a bond B is the par value or face value of a bond Y is the number of years to maturity.

Learn How To Calculate Bond Price Value Tutorial Definition Formula And Example

Bond Yield Calculator

Coupon Bond Formula How To Calculate The Price Of Coupon Bond

Bond Pricing Formula How To Calculate Bond Price Examples

Bond Pricing Formula How To Calculate Bond Price Examples

An Introduction To Bonds Bond Valuation Bond Pricing

Zero Coupon Bond Value Formula With Calculator

Bond Price Calculator Exploring Finance

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

How To Calculate The Current Price Of A Bond Youtube

How To Calculate Bond Price In Excel

Zero Coupon Bond Formula And Calculator Excel Template

How To Calculate Bond Price In Excel

Bond Pricing Formula How To Calculate Bond Price Examples

Bond Price Calculator Formula Chart

Excel Formula Bond Valuation Example Exceljet

Yield To Call Ytc Bond Formula And Calculator Excel Template